In the world of real estate, understanding the various financing options is essential for agents looking to provide the best service. One area that holds significant potential is the Home Equity Conversion Mortgage (HECM), commonly known as a reverse mortgage.

Let’s delve into how the HECM credit strategy works and the advantages it offers, ensuring you are equipped to discuss this option with your prospects.

To start, it’s important to understand that HECM is primarily designed for homeowners aged 62 or older. This financing option allows them to convert a portion of their home equity into cash while still living in their home. Unlike traditional loans, HECM does not require monthly mortgage payments. Instead, the loan balance is paid off when the homeowner sells the home, moves out, or passes away.

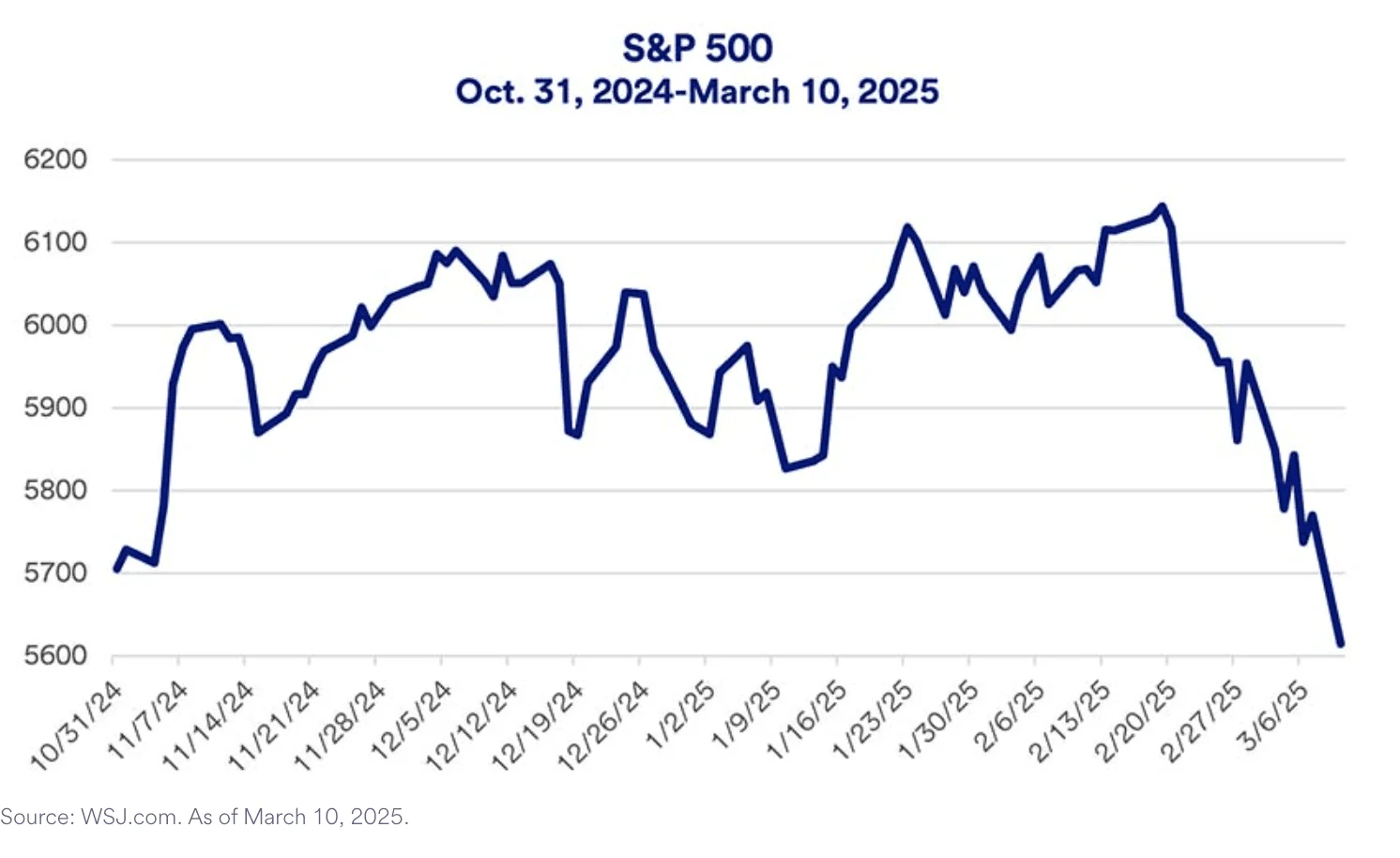

Risk reduction is another critical aspect of HECM that you should highlight to your clients. One of the most significant risks older homeowners face is the potential of outliving their savings. The HECM can serve as a safety net. By accessing their home equity, seniors can avoid withdrawing from their retirement savings accounts during downturns in the market, thereby preserving their investments for a longer period. The Financial Planner Association (FPA) found in a study published in the Journal Of Financial Planning that this strategy can reduce the risk of portfolio exhaustion, running out of money, by as much as 300%.

One way to help your clients navigate the HECM process is to partner with an experienced mortgage professional familiar with reverse mortgage products. By collaborating with a knowledgeable loan officer, you can ensure that your clients receive tailored advice that aligns with their financial goals. This partnership not only enhances the value you provide to your clients but also establishes you as a trusted advisor in their eyes.

Encouraging clients to think about their long-term financial strategy is crucial. HECM can be a component of a larger retirement strategy, allowing clients to maintain a higher standard of living. By having access to their home equity, they can avoid depleting other assets early in retirement, which could lead to a more sustainable financial future.

If you are interested in understanding how HECM can fit into your client’s financial plans or want to discuss how we can collaborate to serve your clients better, reach out to us today. Let’s work together to create more opportunities for your clients and enhance their outcomes through informed mortgage strategies.